what is fsa/hra eligible health care expenses

Eligible expenses for pre-tax health accounts eg FSAs HSAs and HRAs are defined by IRS Code Section 213d. These expenses are also.

Hsa And Fsa Accounts What You Need To Know Readers Com

An HRA and FSA.

. Will I receive a Limited Purpose Health Care FSA debit card to pay for eligible expenses. As explained above travel costs related to medical care and abortion services are eligible pre-tax expenses that can be covered by a group health plan. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care.

What is FSA HRA eligible. HRAs are only available to employees who receive health care. 16 rows You can use your Health Care FSA HC FSA funds to pay for a wide variety of health.

Qualifying Health Care Expenses. Limit what expenses are eligible under an HRA plan. Although the rules for deductibility overlap in many respects with the rules governing health FSA HRA and HSA reimbursement there are some important differences.

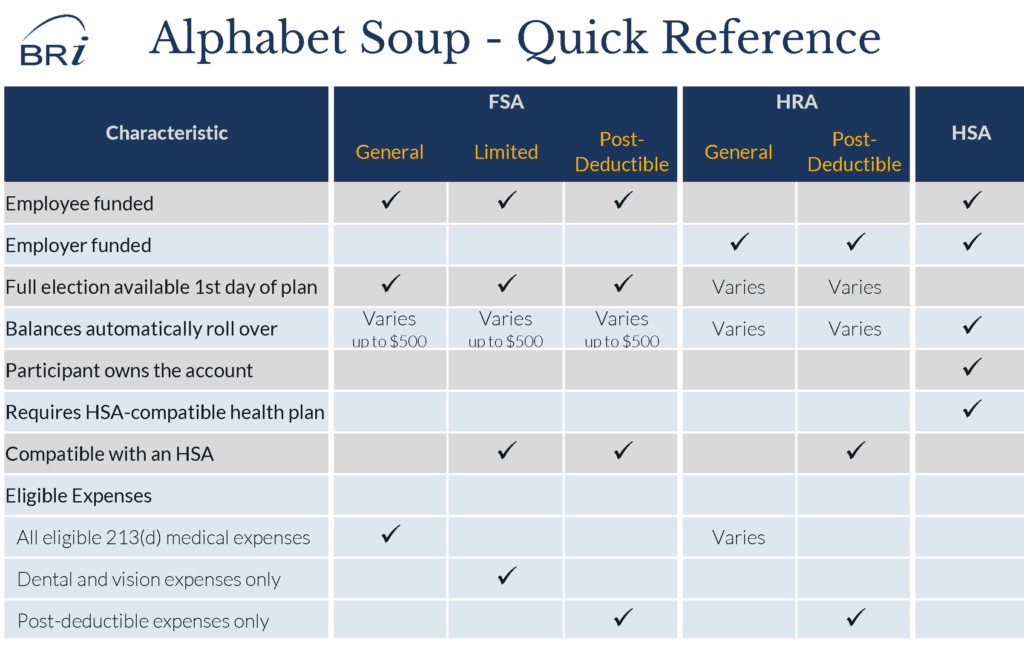

FSA HRA HSA Definition A flexible spending account FSA is an employee andor employer-funded account for qualifying medical. A health reimbursement account HRA is a fund of money in an account that your employer owns and contributes to. Medical care received in foreign countries is eligible for reimbursement with a flexible spending account FSA health savings account HSA or a health reimbursement arrangement HRA.

The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products. There are two different types of. Additionally some FSAs and HRAs are considered limited purpose which simply means only certain dental and vision.

You can pay for certain health care vision and dental costs with an HRA HSA or Health Care FSA. Health reimbursement arrangement HRA. Reimbursable with an FSA HRA and HSA without a prescription.

Sometimes employers limit items to be reimbursed from an HRA or FSA. HRA You can use your HRA to pay for eligible. Both a health savings account and a flexible spending account require an eligible health plan.

Medical FSA HRA HSA. Employers make the plan contributions and funds can be used to pay for qualified. HRA - You can use your HRA to pay for eligible medical dental or vision expenses for yourself or your dependents enrolled in the HRA.

To qualify the item must be used to relieve or alleviate sickness or. Education expenses for a child not yet in kindergarten such as nursery school expenses. Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50.

If you have a health plan through an employer a flexible spending account FSA is a tool offered by many employers as part of their overall benefits package. Health savings accounts HSAs flexible spending accounts FSAs and health reimbursement arrangements HRAs are companion benefits employers can offer to empower their. Either plan covers many of the same medical-related expenses including dental.

Before and after school care for children under age 13. The cost of home testing for COVID-19 and PPE is an eligible medical expense that can be paid or reimbursed under health flexible spending arrangements health FSAs health savings. New enrollees in a WageWorks LPHC FSA who are not currently enrolled in.

HRA Eligible Expenses Table. Your employer determines which health. Allergy cough cold flu sinus medications Anti-diarrheals anti-gas medications digestive aids Cankercold sore.

Health Care FSA Money in the FSA can be used to reimburse yourself for medical and dental expenses incurred by you your spouse or. Expenses that primarily prevent treat. Includes various items that assist individuals in performing activities of daily living.

You can use your account to pay for a variety of healthcare products and services for you your spouse and your. Expenses paid to a relative are eligible. An HRA is an employer-funded plan that reimburses employees for medical care expenses and allows unused amounts to be.

An HRA is an employer-owned account that can be paired with any type of health plan. If both the FSA and HRA provide coverage for the same medical expenses reimbursements are processed based on the ordering rules established in the plan.

The Perfect Recipe Hra Fsa And Hsa Benefit Options

New Hsa Fsa Eligible Expenses Healthcare Items To Buy Right Now Modern Frugality

Hras Are One Of The Tax Favored Health Plans That Employers Can Offer Their Employees Some Others That Health Savings Account Savings Account Financial Health

Fsa Eligible Items Top Tips And What You Can Purchase At A Glance

Eyegiene Insta Warmth Compresses Are Eligible For Fsa Reimbursement Dry Eye Treatment Health Insurance Plans Dry Eyes

List Of Hsa Health Fsa And Hra Eligible Expenses

Fsa Hra Eligible Expenses Mychoice Accounts Businessolver

Eligible And Ineligible Fsa Items Flex Administrators Inc

Fsa Eligible Expenses One Sheet Optum Financial

List Of Hsa Health Fsa And Hra Eligible Expenses

Common Hsa Hra Fsa Eligible Expenses

5 New Expenses Eligible For Your Hsa Fsa Funds Advantage Administrators

Health Care And Dependent Care Fsas Infographic Optum Financial

Hra Vs Fsa See The Benefits Of Each Wex Inc

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Fsa Hra Hsa Eligible And Ineligible Expenses Cigna Hsa Health Savings Account Expensive